Finding out your home needs professional cleanup after a traumatic or hazardous event can feel overwhelming. Beyond the emotional weight, many homeowners are suddenly faced with a pressing question: who pays for this? Cleanup involving contamination is not just expensive; it is also urgent, and most people have never dealt with it before. Understanding how coverage works can make the next steps feel less confusing and more manageable.

Understanding What Biohazard Cleanup Coverage Really Means

The costs tied to hazardous cleanup are often linked to safety, specialized equipment, and strict regulations. This is where biohazard cleanup insurance Alexandria VA becomes an important topic for homeowners trying to navigate unexpected events. Knowing what this type of coverage involves helps you prepare before you are forced into quick decisions.

What Is Biohazard Cleanup Insurance and Why It Matters

Biohazard-related cleanup refers to the professional removal of biological materials that may pose health risks. Biohazard cleanup insurance Alexandria VA is often discussed in connection with whether a homeowner’s policy may assist with these costs, depending on the situation. The reason it matters is simple: these cleanups are not like routine home repairs, and delaying them can increase danger.

Situations That Typically Require Professional Cleanup

Certain events create conditions that cannot be handled with household cleaning supplies. These may include trauma scenes, sewage contamination, or serious hoarding environments. In many cases, homeowners insurance claim processes may apply if the incident is tied to a covered loss. The key is understanding what qualifies and what documentation is needed.

Why Standard Cleaning Isn’t Enough in These Cases

Biohazard cleanup involves invisible threats, such as bacteria and pathogens. Biohazard cleanup insurance Alexandria VA becomes relevant because certified teams use protective gear, hospital-grade disinfectants, and disposal methods approved by law. As the CDC highlights in its cleaning and disinfecting guidance, proper sanitization is essential in contaminated environments. Standard cleaning may spread contamination rather than remove it.

What Types of Incidents Can Lead to Cleanup Costs

Not every hazardous situation looks the same, but many fall into a few common categories. Specialized cleanup is often required when health risks are present, and homeowners may wonder if financial support is available through insurance.

- Trauma or unattended death cleanup: These events can leave biological materials behind that require regulated professional removal.

- Sewage backups and contaminated water: Exposure to sewage can create serious sanitation concerns, often needing urgent cleanup services.

- Hoarding or dangerous waste situations: Severe hoarding may involve mold, pests, or waste that makes the environment unsafe.

In each of these cases, cleanup costs can add up quickly. Understanding what situations may qualify for coverage helps homeowners respond with more clarity and confidence.

What Homeowners Insurance Usually Covers in Biohazard Scenarios

Insurance coverage depends on the cause of the contamination. Many policies cover sudden, accidental events, but exclude gradual conditions. The Insurance Information Institute offers a helpful overview of standard homeowners insurance basics, which can clarify what is typically included in a policy. Understanding homeowners’ insurance claim rules helps set realistic expectations during stressful times.

When Cleanup Is Considered a Covered Loss

If contamination results from a covered peril, such as a fire, burst pipe, or crime-related incident, coverage is more likely. Biohazard cleanup insurance Alexandria VA is often associated with these situations, especially when professional cleanup is required before repairs can begin.

Common Policy Limits and Exceptions

Even when coverage applies, policies may have limits on remediation expenses. A homeowners insurance claim could also be denied if the damage is linked to excluded causes like long-term leaks or neglect. Reading the fine print ahead of time can prevent surprises.

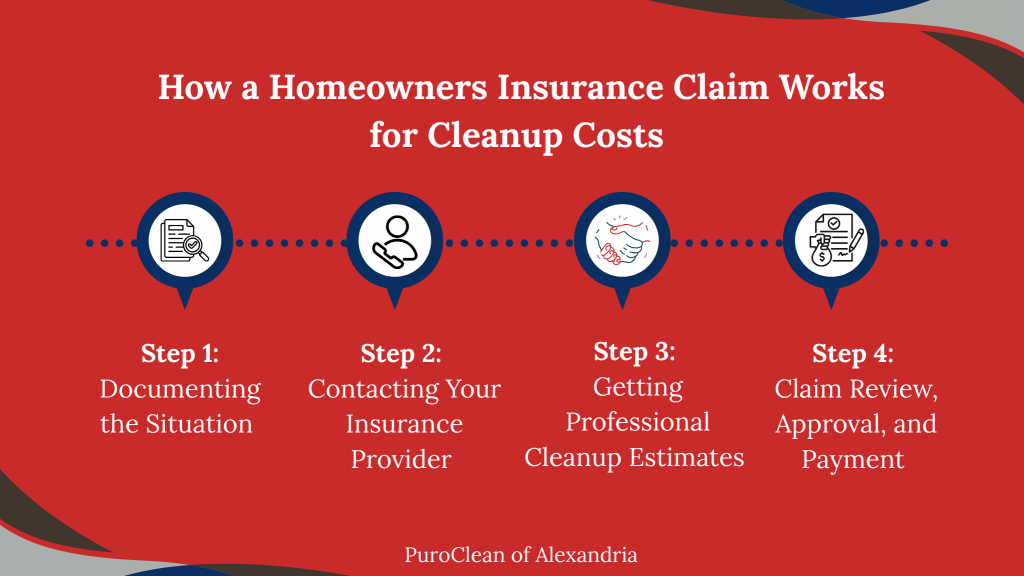

How a Homeowners Insurance Claim Works for Cleanup Costs

The claim process can feel intimidating, but it usually follows a clear structure. The sooner homeowners act, the smoother the outcome tends to be. Many families dealing with urgent cleanup look into biohazard cleanup insurance Alexandria VA, as part of finding financial support.

Step 1: Documenting the Situation

The first step is gathering evidence. Photos, reports, and professional assessments are often required. Starting a homeowners insurance claim without documentation can slow approval, so it helps to record everything carefully.

Step 2: Contacting Your Insurance Provider

Once the situation is stable, contacting the insurer is essential. Biohazard cleanup insurance Alexandria VA, discussions often emphasize early communication because insurers can explain whether cleanup services require pre-authorization.

Step 3: Getting Professional Cleanup Estimates

Insurance companies often want estimates from licensed remediation providers. A homeowners insurance claim is stronger when the contractor provides clear, itemized costs showing why specialized work is necessary.

Step 4: Claim Review, Approval, and Payment

After submission, the insurer reviews the claim, may send an adjuster, and then determines coverage. Biohazard cleanup insurance Alexandria VA becomes important here because professional cleanup providers may already understand how to work with insurers during this stage.

What Can Delay or Deny a Cleanup Claim

Not every claim is approved, and delays can happen. Knowing the common reasons helps homeowners avoid extra frustration. Many people only learn these details after starting a homeowners insurance claim in an emergency.

Exclusions Homeowners Often Overlook

Policies often exclude damage caused by neglect, intentional acts, or long-term contamination. Biohazard cleanup insurance Alexandria VA is sometimes misunderstood as automatic coverage, but it always depends on policy terms.

Why Improper Handling Can Complicate the Process

Attempting cleanup without proper training can worsen contamination and reduce the likelihood of reimbursement. A homeowners insurance claim may be questioned if evidence is disturbed before professionals document the scene.

Choosing a Cleanup Company That Works with Insurance

The company you hire can make the process far easier. Professionals familiar with insurance procedures often reduce stress for homeowners. This is why biohazard cleanup insurance Alexandria VA is often tied to providers who coordinate directly with insurers. If you manage rental property as well, understanding Alexandria landlords and local cleanup responsibilities can also help you choose the right support.

The Role of Licensed Biohazard Professionals

Certified teams follow safety regulations and ensure waste is disposed of legally. A homeowners insurance claim is typically more successful when the work is performed by recognized specialists rather than general contractors.

How Direct Billing Can Reduce Stress

Some cleanup companies work directly with insurance carriers, which can ease paperwork burdens. Biohazard cleanup insurance Alexandria VA, services may include this support, allowing families to focus on recovery instead of financial logistics.

Conclusion

Dealing with hazardous cleanup is never something homeowners expect, and the emotional toll can be just as heavy as the financial one. Understanding how coverage works, what is typically included, and how the process unfolds can make a difficult situation slightly more manageable. Whether coverage applies depends on the cause of the event, the policy language, and how quickly the proper steps are taken. For those facing these circumstances, knowing where biohazard cleanup insurance Alexandria VA fits into the bigger picture can provide clarity when it is needed most.

FAQs

Q1. Does homeowners insurance cover biohazard cleanup?

A: Sometimes. Coverage depends on whether the contamination came from a covered event, and each policy has different limits.

Q2. How long does a cleanup insurance claim take?

A: A homeowners insurance claim timeline can range from a few days to several weeks, depending on the complexity and documentation.

Q3. What should I do first after discovering a biohazard situation?

A: Prioritize safety, avoid touching the area, and contact professionals who can guide the next steps properly.