Table of Contents

When water damage strikes, it can happen fast — and the costs can add up even faster. Understanding water damage insurance is the key to protecting your home and finances when unexpected leaks, burst pipes, or storms hit.

This guide from PuroClean of Burlington explains everything homeowners in Burlington, WI, and surrounding communities like Waterford, Elkhorn, and East Troy need to know about water damage insurance, including what it covers, how deductibles work, and how to make a successful claim.

What Is Water Damage Insurance?

Water damage insurance helps homeowners recover financially after sudden and accidental water-related incidents. It covers the cost of repairs, restoration, and sometimes personal property replacement after events such as burst pipes, appliance leaks, or roof damage from heavy rain.

It’s important to note that standard homeowner policies don’t always cover every type of water loss. For example, flooding from outside sources (like overflowing rivers or storm surges) typically requires separate flood insurance. Always read your policy carefully or consult your agent to clarify what’s included.

Understanding Water Damage Insurance Deductibles

A deductible is the amount you pay out of pocket before your insurance company covers the rest of the repair costs.

For example, if your deductible is $1,000 and you experience $6,000 in water damage, you’ll pay the first $1,000, and your insurance will cover the remaining $5,000.

Your deductible amount directly affects your premiums — a higher deductible usually means lower monthly payments but higher costs when you file a claim, while a lower deductible means you’ll pay more upfront each month but less during an emergency.

For Burlington homeowners, where seasonal risks like snowmelt and ice damming are common, selecting a deductible that balances affordability with protection is key.

Types of Water Damage Covered by Insurance

Plumbing issues, such as burst pipes, leaking roofs, or accidental plumbing leaks are normally covered by insurance.

Not all water damage is treated equally by insurance companies. Generally, sudden and accidental damage is covered, while gradual or maintenance-related damage is not.

Here are the most common situations covered under water damage insurance:

| Type of Damage | Description | Typically Covered? |

|---|---|---|

| Burst Pipes | A pipe bursts due to freezing temperatures or pressure buildup | Yes |

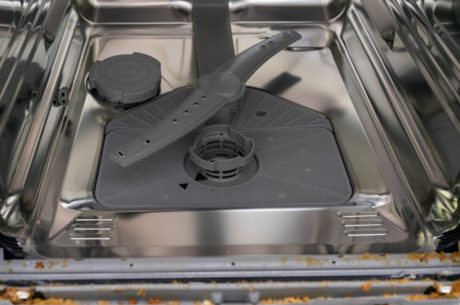

| Appliance Leaks | Leaks from washing machines, dishwashers, or water heaters | Yes |

| Roof Leaks from Storms | Caused by heavy rain, snow, or hail damaging the roof | Yes |

| Gradual Leaks | Slow drips from worn plumbing or poor maintenance | No |

| Flooding from Outside Sources | Water entering from rivers or heavy rainfall | No (Requires flood insurance) |

For Burlington residents, winter weather is a major risk factor. Frozen pipes and ice dams can cause significant indoor flooding — but these incidents are usually covered if the damage happens suddenly and not from neglect.

How Water Damage Insurance Claims Work

When you file a water damage insurance claim, your deductible plays a key role in how much reimbursement you’ll receive.

Let’s say your home sustains $10,000 in water damage and your deductible is $2,000. The insurance company will pay $8,000, leaving you responsible for the deductible portion. The claim process generally includes these steps:

- Damage occurs — for example, a burst pipe in your basement.

- Document the damage with photos and videos immediately.

- Contact your insurance provider as soon as possible.

- Meet with an insurance adjuster who will assess the loss.

- Pay your deductible once the claim is approved.

- Receive reimbursement for the remaining amount covered by your policy.

Choosing the Right Water Damage Insurance Deductible

Selecting the right deductible for your water damage insurance policy is about balancing risk and affordability.

- Evaluate your home’s risk factors: Burlington homes are exposed to heavy snowfall, ice, and freezing temperatures that can increase water damage risks.

- Assess your savings: Make sure you could comfortably pay the deductible if an emergency occurred tomorrow.

- Compare premium differences: Ask your insurance provider for quotes with multiple deductible levels to see how your monthly costs change.

A good rule of thumb: Choose a deductible amount you can pay without financial strain — ideally from an emergency fund.

Tips for Managing Water Damage Risks

Regularly check for any signs of leaks around your home.

Taking proactive measures can minimize your risk and may even lower your insurance premiums. Here are practical steps Burlington homeowners can take:

- Inspect plumbing and appliance connections regularly for wear or leaks.

- Install leak detectors in high-risk areas like basements, under sinks, and near washing machines.

- Keep gutters clear to prevent roof leaks or foundation flooding.

- Insulate pipes before Wisconsin’s freezing winter temperatures set in.

- Schedule annual maintenance for your HVAC and water heater systems.

Preventing water damage not only protects your property but can also keep your insurance rates stable over time.

Filing a Water Damage Insurance Claim

Documenting the extent of the damage will help speed up the claims process and avoid disputes with your insurance company.

If water damage occurs in your Burlington home, act quickly to limit further damage and document every step.

- Take photos and videos immediately after discovering the damage.

- Contact your insurer to report the incident and start the claim.

- Make temporary repairs to prevent further water intrusion, such as shutting off the main water supply or using fans to dry affected areas. Keep all repair receipts for reimbursement.

- Meet with the insurance adjuster to assess the extent of the damage.

- Hire professional restoration experts like PuroClean of Burlington to handle cleanup and repairs safely.

Proper documentation and professional help can significantly speed up claim approval and ensure you receive fair compensation.

Conclusion

Understanding water damage insurance gives you the confidence to protect your Burlington home and your wallet. From knowing what’s covered to choosing the right deductible, preparation makes all the difference when disaster strikes.

If your property has suffered water damage, don’t wait — contact PuroClean of Burlington for fast, professional restoration and insurance claim support. Our experts ensure your home is restored safely, efficiently, and to pre-loss condition.

Call (262) 342-2226 today or visit our website to schedule service or learn more about our water damage restoration solutions.

FAQs About Water Damage Insurance

Q1: Does homeowners insurance cover all types of water damage?

No. It covers sudden and accidental incidents like burst pipes or appliance leaks, but not gradual damage or external flooding.

Q2: How can I find out if my water damage is covered?

Review your policy’s exclusions and call your insurance agent. They can explain what’s covered under your plan.

Q3: Will filing a water damage insurance claim raise my premiums?

It can, depending on the claim size and frequency. Preventive maintenance helps avoid unnecessary claims.

Q4: Is mold damage covered by water damage insurance?

Only if mold results directly from a covered water event and you act quickly to mitigate it.

Q5: Who should I call first after water damage — my insurer or a restoration company?

Call both immediately. PuroClean of Burlington can help document the damage while your insurer opens the claim.

Summary

- Water damage insurance covers sudden, accidental leaks and flooding inside your home.

- Understanding your deductible ensures financial preparedness during emergencies.

- Gradual or neglected damage is usually excluded from coverage.

- Regular maintenance can prevent most water-related claims.

- PuroClean of Burlington provides 24/7 restoration and claim support in southeast Wisconsin.