Why Every Home Needs an Inventory: Protecting What Matters Most

Americans today own more than ever before, which makes having a home inventory more important than ever. Walk into any home, and it’s clear: bigger houses, more rooms filled with furniture, closets overflowing with clothes, and garages so packed with boxes that the car no longer fits inside. In fact, research estimates that the average U.S. household contains over 300,000 individual items. To keep up with our growing accumulation, many people turn to self-storage units. There are now more storage facilities in the United States than McDonald’s and Starbucks combined—a staggering testament to how much we own.

More Stuff, Higher Costs

This increase in belongings isn’t just about clutter—it has serious financial implications. Homes have grown nearly 60% larger since the 1970s, and with that extra space comes more furniture, more electronics, more toys, and more sentimental keepsakes. The more we accumulate, the more expensive it becomes to replace these items if disaster strikes.

For insurance professionals, this trend has had a clear impact. More belongings mean higher replacement values after a loss. And because modern homes are often built with synthetic materials and open floor plans, fires spread faster and burn more completely than in decades past. The combination of more contents and more destructive fires has driven up costs significantly.

Consider this: fire and lightning-related insured home losses have risen by about 45% since 2017, and the average fire claim in 2021 was over $83,000. After a total fire loss, homeowners often face an even greater financial blow, with insurance premiums jumping by an average of 27% nationwide. In some states, those increases can exceed 40%. For families already reeling from a devastating event, these costs add even more strain.

The Overwhelming Task of Rebuilding

Anyone who has lived through a fire understands the emotional toll it takes. Beyond the physical destruction, there’s the painstaking process of cataloging everything that was lost. Most people are shocked when asked to recall every item in their home—every shirt, every book, every kitchen utensil, every tool in the garage. The reality is that when faced with the monumental task of listing thousands of lost belongings, many homeowners give up. They jot down the big-ticket items—televisions, furniture, appliances—but the smaller, everyday items that add up to thousands of dollars often go undocumented and unreimbursed.

For insurance adjusters and restoration professionals, this makes the process even harder. Carriers accepted detailed inventories created by restoration teams, however, the responsibility of valuing the list increasingly falls on the homeowner, who may be overwhelmed and ill-equipped for the job. Without a prepared home inventory, both the claims process and the recovery journey become more stressful and less financially complete.

How a Home Inventory Helps

That’s where a home inventory makes all the difference. A thorough inventory is essentially a roadmap of a family’s belongings—photos, receipts, and descriptions stored safely in an app or cloud-based system. In the event of a loss, homeowners don’t have to rely on memory alone. They can provide their insurance carrier with a clear, accurate list that speeds up the claim and ensures they receive full reimbursement for what was lost.

But the benefits don’t stop there. Creating a home inventory often has an unexpected upside: it inspires people to simplify. As they go room by room, many homeowners realize how much they’ve accumulated—and how much they no longer need. They may choose to donate unused items, recycle old electronics, or finally clear out the clutter in the basement. This not only makes the home feel lighter and more organized but also reduces future replacement costs should a disaster occur.

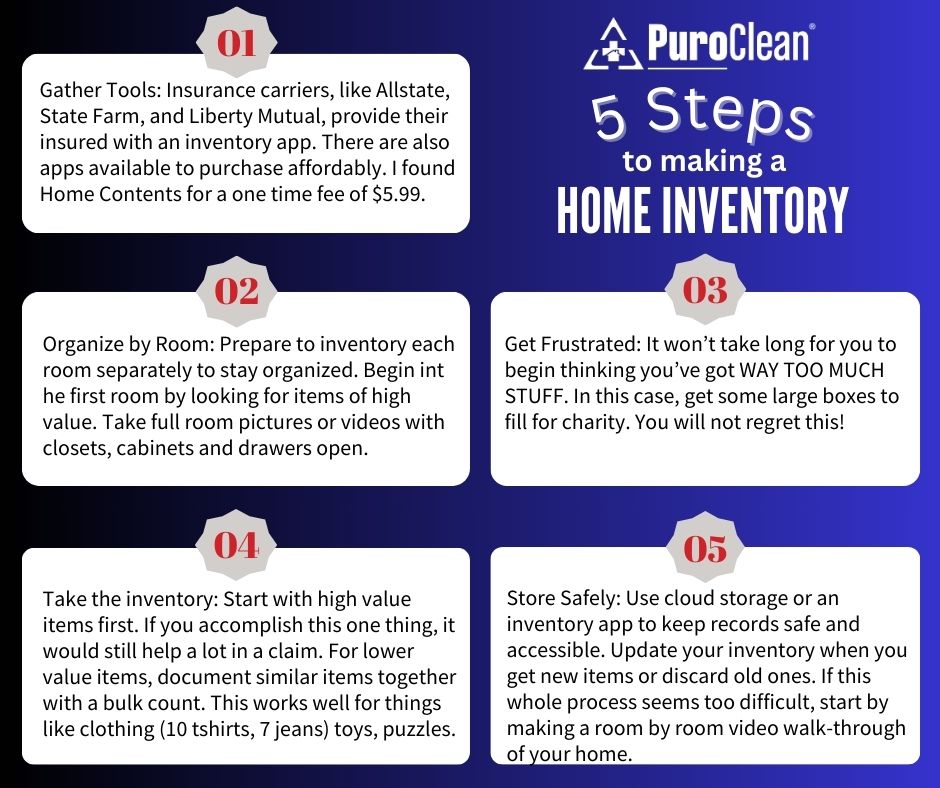

Getting Started: Simple Steps to Build Your Inventory

While the idea of documenting an entire household may seem daunting, breaking it down into small steps makes it manageable:

- Start with the big stuff. Focus on major items like furniture, appliances, and electronics.

- Use your phone. Snap photos or take short videos of each room, capturing shelves, drawers, and closets.

- Track receipts if you can. For higher-value items, store purchase receipts or warranty info.

- Leverage technology. Inventory apps make it easy to categorize, update, and store information securely.

- Update regularly. Revisit your inventory once a year, or anytime you make a significant purchase.

Even a partial inventory is far better than none at all. The key is to start somewhere and build over time.

Peace of Mind for the Future

In today’s world, where Americans own more, store more, and lose more in disasters, a home inventory is one of the most practical steps a family can take to protect themselves. It lightens the emotional and financial burden after a loss, ensures more accurate insurance reimbursement, and often leads to a simpler, less cluttered life.

For homeowners, the message is clear: don’t wait until it’s too late. Take the time to create a home inventory now. It’s a small investment of effort that could make all the difference when the unexpected happens.

Bottom line: Our homes are filled with more belongings than ever before, and when fire strikes, the cost of replacement is rising rapidly. A home inventory provides not only financial protection but also peace of mind—and may even inspire us to live with a little less.

📞 Need help after a fire? Call us today at 812-801-4485. We’re here to guide you through the restoration process with care and expertise.

Here is a link to a paper home inventory form from Allstate