Water damage is one of the most common and expensive issues homeowners in California face, whether it’s caused by sudden plumbing failures or unexpected storms. But while water can cause extensive property damage quickly, not all types are covered by insurance.

Knowing what your policy does and doesn’t cover can help you avoid costly surprises and take the right steps when disaster strikes. Being proactive about your water damage insurance coverage can also make recovery smoother and less stressful.

Navigating Water Damage Insurance Coverage in California

Homeowners often assume that their insurance will cover any water-related damage, but that’s not always true. In California, where water issues may stem from floods, storms, or old pipes, it’s essential to understand the specifics of your coverage. Water damage insurance coverage usually applies to sudden, accidental events, but may exclude damage caused by negligence, slow leaks, or natural floods.

Property and casualty (P&C) insurance, like homeowners’ insurance, is designed to protect your home and belongings from these types of perils. In addition, it helps cover your liability if someone is injured on your property or if your actions cause damage to someone else’s. This kind of protection is typically included under homeowners insurance water damage policies.

Water Damage Is More Common Than You Might Expect

Many homeowners underestimate how frequently water intrusion occurs. Nationwide, about 1 in 60 insured homes file a claim for water or freezing damage each year. California sees its share of such claims, influenced by factors like seasonal changes, infrastructure challenges, and unpredictable weather patterns.

Even small incidents, like a leaking dishwasher hose, can lead to significant repair costs if not caught early. Having solid water damage insurance coverage gives homeowners peace of mind when the unexpected happens.

What Does Homeowners Insurance Typically Include?

Before filing a claim, it helps to understand what’s actually included in most homeowners’ policies. The homeowners insurance water damage protection typically covers:

- Burst or leaking pipes that cause sudden flooding

- Overflow from sinks, toilets, or bathtubs (as long as it’s accidental)

- Storm-related roof leaks (if wind or hail damage the roof)

- Water ruin caused by extinguishing a fire

Policies may cover repairs to walls, ceilings, floors, and personal belongings affected by the water. Some may even include mold remediation if it results from a covered water event and is addressed promptly. Having a strong water damage insurance coverage policy ensures you don’t pay out of pocket for situations like these.

What’s Not Covered Under Water Damage Insurance?

Insurance companies often exclude losses that are considered preventable or caused by long-term neglect. To avoid misunderstandings with your water damage insurance coverage, always review the exclusions section of your policy or consult your agent.

Common exclusions include:

- Leaks that occurred slowly over weeks or months

- Damage from poor maintenance, like clogged gutters or ignored roof issues

- Floodwater from overflowing rivers, heavy rain, or mudslides

- Sewer or drain backups, unless you’ve added an endorsement

- Mold growth due to delays in cleanup

How Insurance Companies Classify Water Damage

Insurance providers categorize water damage based on two key factors: the category of water and the class of damage.

Categories of Water:

Category 1: Clean water (from a broken pipe or rainwater)

Category 2: Gray water (lightly contaminated, e.g., washing machine overflow)

Category 3: Black water (heavily contaminated, e.g., sewage)

Classes of Damage:

Class 1: Minimal area affected

Class 2: 5–40% of the area affected

Class 3: More than 40% saturated

Class 4: Deep saturation in porous materials (like hardwood or insulation)

Understanding this classification helps homeowners and restoration companies communicate more effectively with insurance adjusters and speed up water damage insurance coverage approval.

Should You Call a Restoration Company or Your Insurance First?

When you discover it, you may be unsure who to call first: your insurance provider or a property restoration company. Here’s a practical guide:

- If water is actively flowing and you can’t stop it: Call a plumber first.

- If the leak has stopped and damage is visible: Call your insurance company.

Many policies, including homeowners insurance water damage coverage, require taking reasonable steps to prevent further damage. So stopping the source quickly is vital.

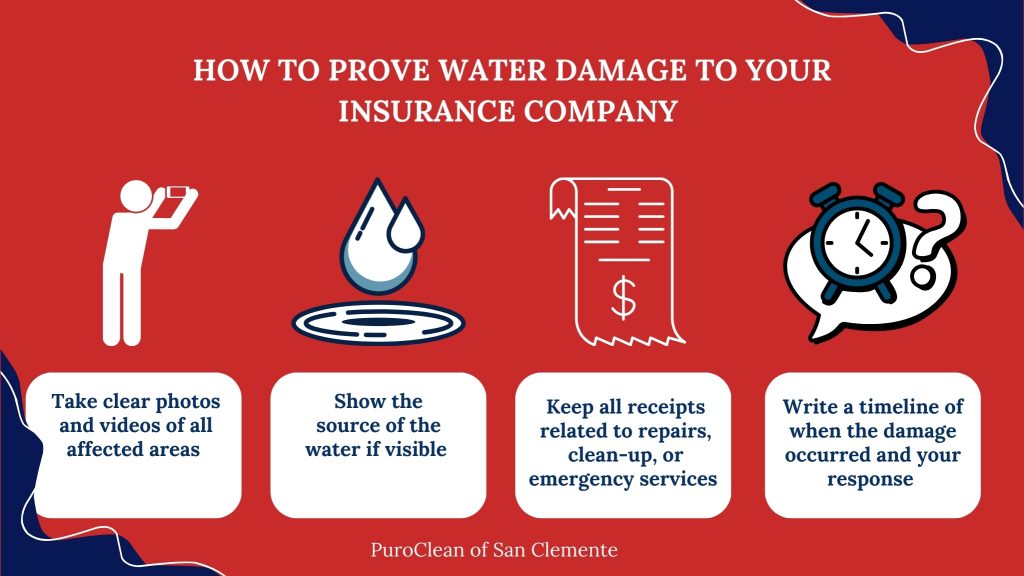

How to Prove Water Damage to Your Insurance Company

When filing a claim, documentation is everything. Detailed records can speed up the water damage insurance coverage process and help avoid unnecessary delays. Here’s how to build a solid case:

- Take clear photos and videos of all affected areas

- Show the source of the water if visible

- Keep all receipts related to repairs, clean-up, or emergency services

- Write a timeline of when the damage occurred and your response

Having thorough evidence not only strengthens your claim but also helps the insurance adjuster understand the full extent of the damage. Being proactive and organized will make the entire claims process smoother.

How the Claims Process Works Step-by-Step

Filing a claim may feel overwhelming, but staying organized and keeping communication open can help you get the most from your water damage insurance coverage. The process typically follows these steps:

- Contact your insurance provider as soon as possible.

- Submit documentation (photos, receipts, timeline).

- An adjuster is assigned and schedules a visit.

- Damage is assessed, and the claim is reviewed.

- Decision is made: The insurer pays out based on covered losses, minus your deductible.

- Repairs begin, often involving licensed restoration professionals.

Maintaining clear communication with your insurer throughout can prevent misunderstandings or delays. Keep records of all conversations and confirmations for your reference.

Tips for Getting the Most from Your Coverage

Regularly updating your homeowners insurance water damage policy ensures you’re always protected. Maximize your insurance benefits with these smart strategies:

- Understand your deductible and coverage limits

- Add endorsements for sewer backup or mold if you live in a high-risk area

- Review your policy annually, especially after home upgrades

- Keep a home inventory with photos and receipts for valuable items

- Act fast to mitigate damage; delays can hurt your claim

Taking these steps not only safeguards your home but also helps avoid surprises when you need to file a claim. Staying informed and prepared is key to protecting your investment.

Do You Need Flood Insurance in California?

Here’s a critical fact: Standard insurance policies do not include flood damage. If a storm, overflowing river, or mudslide causes water to enter your home, your water damage insurance coverage won’t apply; you’ll need separate flood insurance to receive compensation.

Most flood insurance is provided through FEMA’s National Flood Insurance Program (NFIP), though some private insurers also offer it. Policies typically cover both the structure of the home and its contents.

For California residents, being proactive is key to minimizing risk. For a deep dive on specific regional issues, you can learn more about how to prevent water damage during San Clemente’s rainy season and take proactive steps early. Be aware that flood insurance usually comes with a 30-day waiting period, so don’t wait until a storm warning to buy it.

Conclusion

Water wreckage can happen suddenly, and the financial toll can be steep. But if you understand your water damage insurance coverage, act fast, and document everything properly, you can protect your home and ease the recovery process. Review your policy carefully, know what’s covered and excluded, and don’t hesitate to ask questions or add extra protection for peace of mind.

FAQs

Q1: Is flood damage ever covered by standard homeowners insurance?

A: No, flood damage from outside sources like rivers or heavy rainfall is excluded. You need a separate flood insurance policy for that type of protection.

Q2: How long does it take for a water damage claim to be processed?

A: It varies, but most claims are reviewed within a few days to a few weeks. Providing clear photos and documentation helps speed things up.

Q3: What if I wait too long to report the damage?

A: Delaying your claim or failing to mitigate further damage could lead to denial or reduced compensation. Always report the issue as soon as it’s safe to do so.