When disaster strikes—whether it’s water damage from a burst pipe, fire damage from a kitchen accident, or storm damage—knowing how to file a claim can save you time, money, and frustration. This guide explores the most important insurance claim tips in Bloomington, helping homeowners feel prepared and confident throughout the claims process. You’ll learn what to do immediately after damage, how to document your losses, how to communicate effectively with your insurance provider, and when to call in professional restoration help.

Table of Contents

Why Insurance Claim Tips in Bloomington Matter

Dealing with property damage is stressful enough, but add in the complexity of an insurance claim, and it can feel overwhelming. Insurance companies have their own procedures, language, and requirements. Missing a step or failing to document damage properly can delay your claim or reduce your payout. That’s why following proven insurance claim tips in Bloomington is so important.

1. Act Fast but Stay Calm

One of the first insurance claim tips in Bloomington is to take action quickly without panicking. Contact your insurance company as soon as possible to report the damage. Delays may lead to complications or even denial of your claim. At the same time, avoid rushing into repairs before your adjuster has inspected the damage, unless it’s necessary to prevent further harm.

2. Document Everything Thoroughly

Perhaps the most crucial of all insurance claim tips in Bloomington is documentation. Take clear, timestamped photos and videos of the damage before moving or cleaning anything. Make an inventory of damaged belongings, including approximate values and purchase dates if possible. Keep all receipts for temporary repairs, lodging, or cleanup supplies—your insurer may reimburse these.

3. Understand Your Policy

Many homeowners only skim their insurance policy until disaster strikes. One overlooked but valuable insurance claim tip in Bloomington is to understand your coverage before you need it. Know your deductible, policy limits, and exclusions. Some policies cover water damage but not flooding. Others may cover fire and smoke damage but have limits on personal belongings. Being informed puts you in a stronger position when negotiating your claim.

4. Communicate Clearly with Your Adjuster

When the insurance adjuster arrives, walk them through the property and provide your documentation. Another overlooked insurance claim tip in Bloomington is to stay professional and factual. Avoid exaggeration but make sure you don’t downplay the damage either. Be available to answer follow-up questions and provide additional evidence if requested.

5. Avoid Common Mistakes

Even well-meaning homeowners make errors that can cost them in the claims process. Among the top insurance claim tips in Bloomington is to avoid signing off on the claim too early. Once you accept the settlement, it may be final, even if you later discover additional damage. Also, avoid throwing away damaged items before the adjuster sees them.

6. Work with Trusted Restoration Experts

Sometimes, insurance companies recommend contractors—but remember, the choice is ultimately yours. One of the best insurance claim tips in Bloomington is to partner with a reputable restoration company like PuroClean of Bloomington. A professional team not only repairs your property but also helps ensure your claim is properly supported with detailed reports and estimates.

7. Keep Organized Records

Finally, keep a dedicated folder—physical or digital—with all correspondence, receipts, photos, and claim-related documents. One of the simplest yet most effective insurance claim tips in Bloomington is staying organized. This helps you track progress, follow up with adjusters, and protect yourself if disputes arise.

FAQs About Insurance Claim Tips in Bloomington

Q1: How soon should I contact my insurance company after damage?

As soon as possible. Prompt notification is one of the most important insurance claim tips in Bloomington, as delays can complicate your claim.

Q2: Can I start repairs before the adjuster arrives?

Only if necessary to prevent further damage. Take photos first, and save all receipts for reimbursement.

Q3: Do I have to use the insurance company’s recommended contractors?

No. You’re free to choose your own. Many homeowners prefer trusted local companies like PuroClean of Bloomington for quality assurance.

Q4: What if my claim is denied?

If denied, review the denial letter carefully and compare it with your policy. You may appeal the decision, and working with an experienced restoration company can strengthen your case.

Q5: How do I know if all my damages are covered?

Review your policy and consult with your adjuster. Remember, one of the key insurance claim tips in Bloomington is to fully understand your coverage details.

Final Thoughts on Insurance Claim Tips in Bloomington

Filing an insurance claim after a disaster doesn’t have to be overwhelming. By following these insurance claim tips in Bloomington, you can take control of the process, protect your home, and maximize your coverage. From documenting everything to choosing the right restoration partner, each step strengthens your claim and reduces stress.

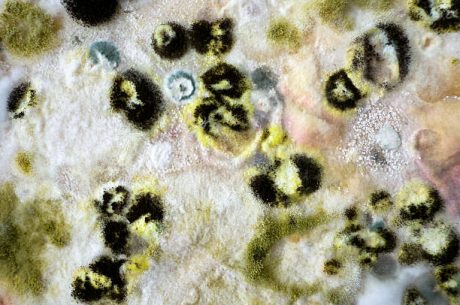

Why Call PuroClean of Bloomington

When you’re dealing with water damage, fire damage, mold, or storm damage, having the right restoration partner makes all the difference. At PuroClean of Bloomington, we don’t just restore your property—we help you navigate the insurance process with confidence. Our team provides detailed damage assessments, professional documentation, and trusted repairs that get your life back on track faster.